This Little-Known AI Stock Is Up 70% in 2025 and Analysts Think It Can Rally Further From Here

The artificial intelligence (AI) sector is expanding at a rapid pace, with global AI platform revenues expected to grow at a 38.9% compound annual rate from $18.22 billion in 2025 to $94.30 billion by 2030. As demand rises, major technology companies are racing to deliver secure and scalable solutions that can support this new era of intelligent software, ranging from MLOps platforms to edge AI and reliable deployment frameworks.

One company that has stepped into the spotlight during this surge is JFrog (FROG). In 2025, the company introduced a series of new AI products at its annual SwampUP event. Among the announcements was an expanded partnership with Nvidia (NVDA), which places JFrog directly in the middle of enterprise AI pipeline management. With these updates, JFrog is positioning itself as an important player in securing the software supply chain and overseeing the delivery of AI models, offering enterprise customers transparency and tighter control in an area gaining increasing attention.

Shares of JFrog are up around 70% so far this year, and Wall Street sentiment continues to strengthen. This strong performance raises an important question for investors: what is driving this leap, and is there still more upside ahead for this AI underdog? Let’s dive in.

Numbers That Explain FROG's 70% Surge

JFrog, known as the "Liquid Software" company, has built its business around helping enterprises manage and secure their software supply chain. Its platform supports modern DevOps practices, allowing companies to deliver software updates on a continuous and reliable basis.

Over the last 52 weeks, JFrog’s shares have climbed 78%, and year-to-date (YTD) they are up just a hair over 70%, far ahead of the broader market.

That rally has pushed the company’s market cap to about $5.8 billion, with FROG stock trading near $49.89. In terms of valuation, JFrog’s forward price-to-earnings (P/E) ratio stands at 71x, compared to an industry average of 24x, showing that investors are paying a premium for its growth outlook.

The company’s latest results help explain why. In the second quarter of 2025, JFrog reported revenue of $127.2 million, a 23% increase from the prior year. GAAP gross profit came in at $97 million with a margin of 76.3%, while non-GAAP gross profit reached $105.7 million at 83.1%. Although the company recorded a GAAP operating loss of $26 million, non-GAAP operating income was $19.4 million with a margin of 15.2%.

Net loss per share was ($0.19), but on a non-GAAP basis, diluted EPS was $0.18. Cash flow remained strong, with $36.1 million from operations and $35.5 million in free cash flow, supported by $611.7 million in cash and investments. Moreover, remaining performance obligations totaled $476.7 million, signaling steady demand across its customer base.

Uncovering the Engines Behind Future Growth

JFrog has spent much of this year introducing new AI-driven features. One standout is its agent-based remediation tools, which use AI to automatically find and fix software vulnerabilities as developers write code. The company is positioning itself as an early leader in securing the software supply chain in real time by blending contextual analysis with rule-based remediation.

JFrog has also introduced JFrog Fly, the first agentic repository designed specifically for AI-native software delivery. This platform uses intelligent agents to manage artifacts across the software lifecycle, giving development teams a more efficient way to move from building to production. It builds directly on JFrog’s strength in DevOps while tapping into the market’s shift toward automated, AI-led workflows.

The company also launched its AI Model Catalog, which is aimed at helping enterprises securely deploy and govern AI and machine learning models. A key detail here is that it provides access to NVIDIA’s Nemotron open-source family of models, known for their efficiency and accuracy. This partnership adds credibility to JFrog’s AI approach while expanding its reach among large enterprise clients.

Finally, JFrog rolled out its Model Context Protocol (MCP) Server, which allows large language models and AI agents to interact directly with tools and data inside the JFrog platform. This is designed to lift productivity for developers while tying JFrog even closer to the AI development pipeline.

What Wall Street Sees on the Horizon for JFrog

Looking ahead, management expects third quarter 2025 revenue to come in between $127 million and $129 million, with non-GAAP operating income between $16.5 million and $18.5 million. Non-GAAP net income per diluted share is projected to fall in a range of $0.15 to $0.17, based on about 122 million shares outstanding.

For the full fiscal year, JFrog has guided for revenue of $507 million to $510 million, non-GAAP operating income of $75 million to $78 million, and diluted earnings per share between $0.68 and $0.70.

These projections, together with recent results, have encouraged analysts to revise their outlooks. Raymond James lifted its price target from $50 to $55 while keeping an “Outperform” rating, pointing to strong momentum in JFrog’s cloud business and continued growth in its enterprise customer base.

Cantor Fitzgerald also raised its target, moving from $46 to $55, and maintained a “Buy”-equivalent stance. The firm highlighted JFrog’s growing presence as it rolls out new AI-driven tools, signaling broader adoption across its customer base.

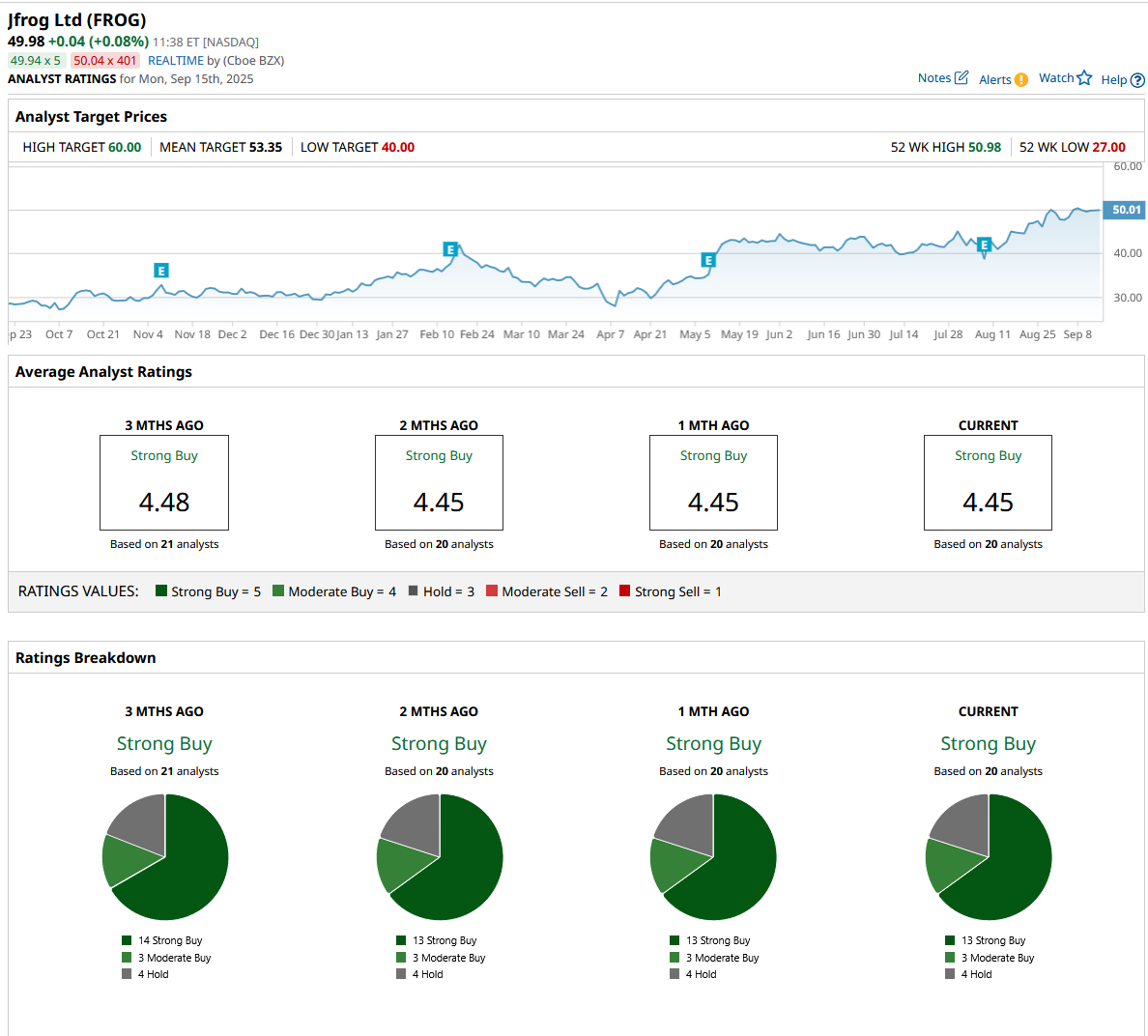

The overall view from Wall Street remains highly positive. All 20 analysts covering the stock currently rate it a consensus “Strong Buy,” showing a rare level of consensus. Their mean price target now stands at $53.35, suggesting a 6.7% upside from the stock’s current level.

Conclusion

JFrog may not be the first name that comes to mind when investors think of AI, but 2025 has firmly put it on the map. The company’s rapid-fire rollout of agentic AI tools, combined with its growing collaboration with Nvidia, has given Wall Street fresh confidence in its long-term potential. With shares already up 70% this year, analysts still see more room to climb, even if it's at a more measured pace from here. Given its strong fundamentals, accelerating enterprise adoption, and clear positioning at the intersection of DevOps and AI, the stock looks more likely to grind higher than give back gains anytime soon.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.