Is DoorDash Stock Outperforming the Nasdaq?

With a market cap of $110.2 billion, DoorDash, Inc. (DASH) connects merchants, consumers, and independent contractors through its global commerce platform. Operating marketplaces such as DoorDash and Wolt, the company provides services ranging from food delivery and order fulfillment to merchant tools and customer support.

Companies valued at $10 billion or more are generally classified as “large-cap” stocks, and DoorDash fits this criterion perfectly. In addition, DoorDash offers membership programs like DashPass and Wolt+, along with white-label delivery solutions through DoorDash Drive and Wolt Drive.

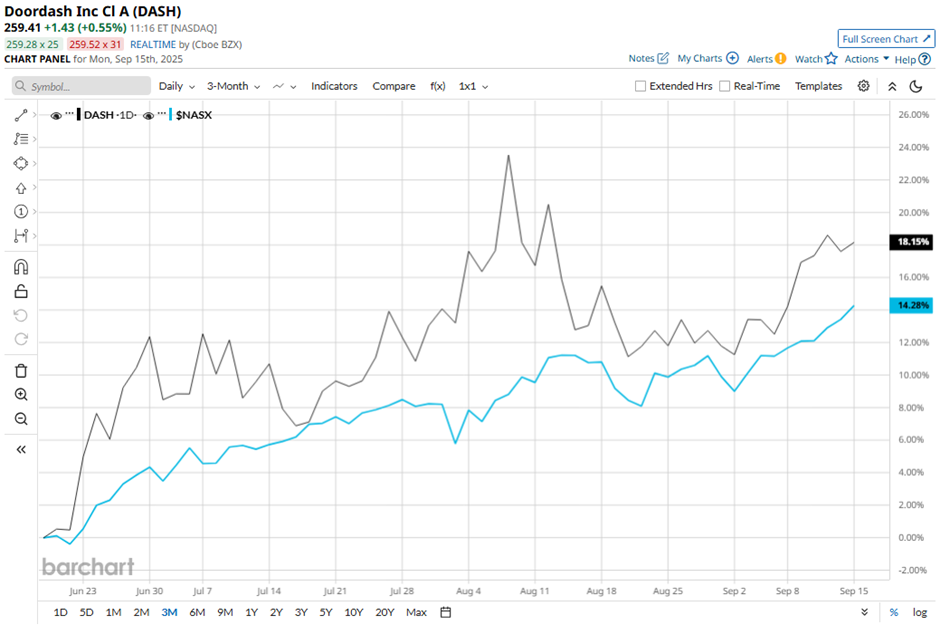

Despite this, shares of the Francisco, California-based company have declined 6.9% from its 52-week high of $278.15. DASH stock has increased 18.3% over the past three months, outperforming the Nasdaq Composite’s ($NASX) 14.9% return over the same time frame.

In the longer term, shares of DoorDash have climbed 54.4% on a YTD basis, surpassing NASX’s 15.5% gain. Moreover, shares of the company have surged 97.2% over the past 52 weeks, compared to NASX’s over 26% return over the same time frame.

Despite a few fluctuations, the stock has been trading above its 50-day and 200-day moving averages since last year.

Shares of DoorDash jumped 5% following its Q2 2025 results on Aug. 6 after Q2 2025 results as the company delivered EPS of $0.65, beating estimates. Revenue rose 24.9% year-over-year to $3.3 billion, ahead of the consensus, while Marketplace GOV surged 23% to $24.2 billion with total orders up 20% to 761 million. Investor optimism was further fueled by guidance for Q3 GMV of $24.2 billion - $24.7 billion, above estimates, signaling continued strong demand in food, grocery, and non-food delivery.

In contrast, rival Coupang, Inc. (CPNG) has performed weaker than DASH stock. CPNG stock has soared 50.9% on a YTD basis and 38.5% over the past 52 weeks.

Despite the stock’s strong performance, analysts remain cautiously optimistic on DASH. The stock has a consensus rating of “Moderate Buy” from the 38 analysts in coverage, and the mean price target of $294.38 is a premium of 13.5% to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.