This Space Stock Just Got a New Street-High Price Target

/A%20concept%20image%20of%20space_%20Image%20by%20Canities%20via%20Shutterstock_.jpg)

Space exploration is no longer the exclusive domain of governments. Thanks to rising private sector involvement, the industry is on track to become a multi-trillion-dollar economic force. Consulting powerhouse McKinsey & Company projects that space-related activity could inject a staggering $1.8 trillion into the global economy by 2035, driven largely by the rapid expansion of satellite networks and their far-reaching impact across various industries on Earth.

That said, while Elon Musk’s SpaceX remains a leading force in this domain, its private status keeps it out of reach for everyday investors. And that’s where Rocket Lab (RKLB) enters the picture. As one of the only independent space providers capable of competing in the same orbit as SpaceX, Rocket Lab’s stock has wooed investors thanks to improving fundamentals, an expanding space systems portfolio, frequent launches, and growing industry credibility.

In fact, Wall Street is certainly beginning to take note. Citi analyst Jason Gursky recently raised his price target on Rocket Lab to a new Street high of $50, well above the prior $33 target, highlighting rising confidence in the company’s potential. With that in mind, here’s a closer look at this fast-moving space stock.

About Rocket Lab Stock

Founded in 2006, Rocket Lab has evolved into a comprehensive space company with a proven track record of successful missions. The California-based company offers a range of services, from reliable satellite launches to spacecraft manufacturing and on-orbit management, making access to space faster, easier, and more cost-effective.

Rocket Lab is best known for its Electron rocket, which has become the second-most frequently launched U.S. orbital rocket since its debut in 2018, delivering over 200 satellites into orbit for a mix of public and private clients. These missions support a range of activities, including national security, scientific research, climate monitoring, and communications. Just last month, Rocket Lab successfully completed its 68th Electron launch, delivering a satellite to orbit for a confidential commercial customer.

The mission also set a new company record as the second launch from the same site in under 48 hours. Rocket Lab is also working on its larger Neutron rocket, designed to compete with SpaceX’s Falcon 9 and support satellite constellations. Since its Nasdaq debut in August 2021 through a special purpose acquisition company (SPAC) merger, Rocket Lab's market capitalization has swelled to roughly $21 billion.

With a monster 723% rally over the past year that dwarfs the broader S&P 500 Index’s ($SPX) 17% return, Rocket Lab has kept its momentum going in 2025, adding 72% year-to-date (YTD). Over the past three months alone, RKLB stock has surged 95%, driven by bullish analyst coverage, a series of successful launches and a major deal with the European Space Agency (ESA).

A Look Inside Rocket Lab’s Q1 Earnings Report

Rocket Lab kicked off fiscal 2025 with a strong start, as its first-quarter earnings report on May 8 highlighted steady revenue growth and continued momentum across both its launch and space systems segments. The company delivered a record $122.6 million in revenue, representing an impressive 32% increase over the same period last year. Operationally, Rocket Lab delivered a flawless performance, achieving 100% mission success for Electron during the quarter.

It completed five launches supporting Earth-imaging, monitoring, intelligence, and global wildfire detection missions. Notably, the company successfully executed three of those launches in just 13 days, a rapid pace that highlights its growing efficiency and reliability. Meanwhile, Rocket Lab continues to advance its next-generation Neutron rocket, with Stage 2 qualification now complete and Stage 1 qualification in progress.

A key highlight from the quarter was Neutron’s selection for the U.S. Space Force’s National Security Space Launch (NSSL) Phase 3 Lane 1 program, a major $5.6 billion initiative aimed at supporting critical national security missions. In fact, total operating expenses increased 40% annually in the first quarter, primarily driven by a rise in investment in Neutron development. GAAP R&D spending rose to $55.1 million, reflecting Rocket Lab’s accelerated focus on its next-gen launch vehicle.

On the bottom-line side, the company reported a net loss of $0.12 per share, worsening from a $0.09 loss per share in the same period last year. However, margins showed encouraging signs of improvement. GAAP gross margin rose to 28.8% in Q1 2025 from 26.1% a year ago, while non-GAAP gross margin improved to 33.4% from 31.7%. The company’s backlog remained strong at $1.067 billion, with 60% tied to space systems and 40% to launch services.

Commercial customers accounted for 54% of the backlog, while government clients made up the remaining 46%. Looking ahead to Q2, which is scheduled to be reported next month, Rocket Lab expects revenue to land between $130 million and $140 million, with non-GAAP gross margins forecast in the range of 34% to 36%. Additionally, operating expenses for the quarter are projected to range between $96 million and $98 million, as the company continues to scale its infrastructure and development efforts.

What Do Analysts Expect for Rocket Lab Stock?

On July 14, Rocket Lab shares popped nearly 11% after Citi analyst Jason Gursky boosted his price target from $33 to $50 while keeping a “Buy” rating on the stock. The upgrade came as Gursky shifted his valuation to reflect the company’s longer-term outlook, projecting revenue to reach around $2.6 billion by 2029.

Gursky pointed to several key areas that could drive momentum, including ongoing progress with the Neutron rocket, potential updates from the U.S. Department of Defense, and the company’s ability to land more launch contracts.

Looking ahead, the analyst expects Rocket Lab’s growth to be driven by approximately 20 Neutron launches per year and a steady increase in satellite construction successes. The forecast also includes around $50 million in annual revenue from the Geost acquisition, which is expected to close in the second half of 2025.

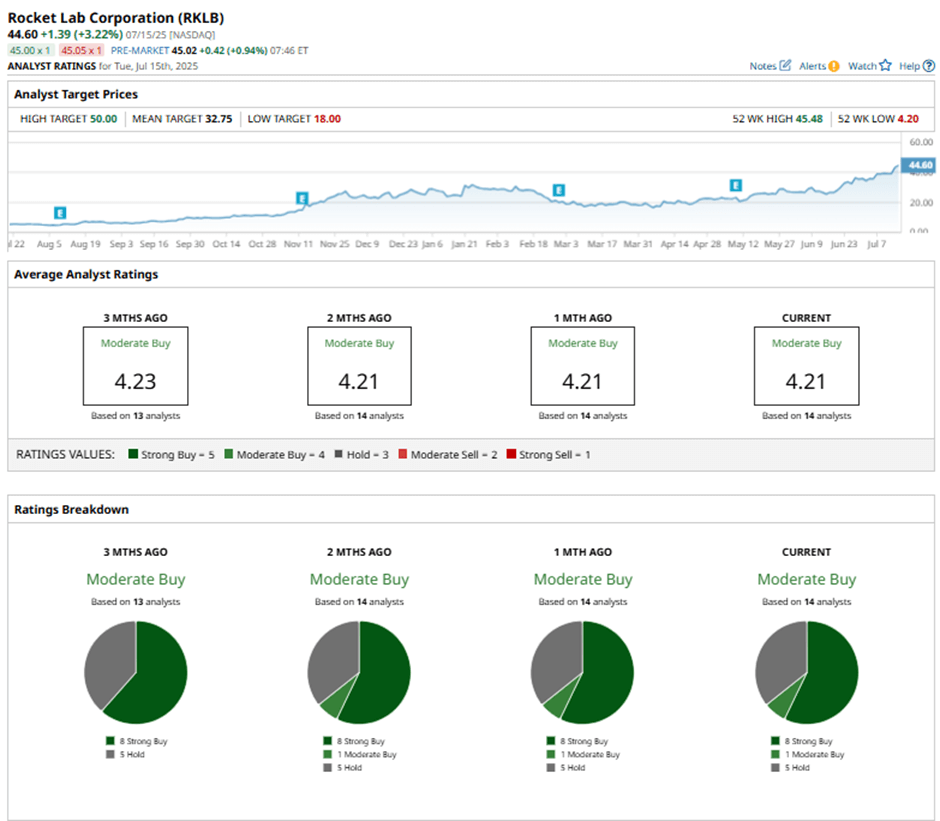

Overall, RKLB stock continues to earn Wall Street’s trust, holding a steady “Moderate Buy” consensus rating as analysts remain optimistic about its growth in the expanding space economy. Of the 15 analysts offering recommendations, eight advocate a “Strong Buy” rating, one gives a “Moderate Buy,” and six suggest a “Hold.” The stock is already trading at a premium to its average price target of $34.42. However, Citi’s Street-high target of $50 suggests that RKLB can still rally as much as 14% from here.

On the date of publication, Anushka Mukherji did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.